Telemundo News

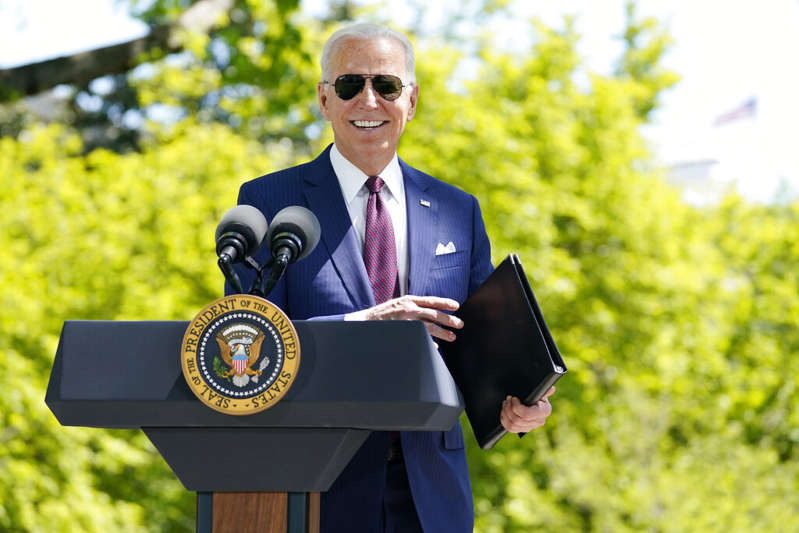

The president, Joe Biden, presented his Plan for American Families on Wednesday, an ambitious investment project that seeks to expand the tax credit of up to $3,600 per child by 2025 and guarantee at least four more years of free education for all students in the country,among other measures.

The proposal includes about $1 trillion in investment and $800 billion in tax credits for families to be used for a decade.

In his speech to wednesday night’s nation, Biden defended his investment package for families by ensuring that the country needs it to remain competitive with the rest of the world.

“We need to make an investment in our families and children,” Biden said. “The world is catching up and it’s catching up with us, they’re not going to wait for us, and what are we going to do? 12 years [of education] is no longer enough to compete with the rest of the world, which is why my plan on American families guarantees another 4 years of education,” he said.

The total amount of $1.8 trillion would be paid in full in 15 years through an increase in taxes on the wealthiest and a legal strategy to prevent tax evasion, White House officials advanced in a meeting with reporters Tuesday night.

The bill would join Biden’s $2 trillion infrastructure plan on March 31 and with which the representative also hopes to add up millions of better-paid jobs for families, although its approval in Congress remains uncertain.

It would also complement Biden’s $1.9 trillion U.S. rescue plan,which has provided 161 million people with payments of up to $1,400 and expanded vaccination eligibility for all over-16s. This plan is expected to help get more than 5 million children out of poverty this year through tax credits to families of $3,600 for every child under the age of 6 and $3,000 for children between the age of 6 and 17.

The U.S. Family Plan seeks to expand that tax benefit, which will be fully repayable for low- and middle-income families, through 2025. On average, it would save households about $13,000.

“In addition to helping families make the end of the month, tax credits for working families have been shown to improve children’s academic and economic performance over time,” authorities said in a statement.

The Internal Revenue Service (IRS) will begin sending monthly payments of the new $3,000 tax credit per child in July, Commissioner Charles Rettig said on April 14 during a Senate Finance Committee hearing.

Previously, up to $2,000 per child could be claimed as tax aid, which began to be lost when income reached $200,000 for individuals and $400,000 for married couples. It has been in place since a Republican-led tax reform in 2017 and is an annual tax credit.

But millions of very low-income households don’t get full credit because they don’t pay enough tax or don’t get enough income to apply.

Free preschool for all children between 3 and 4 years old

The U.S. Family Plan, which was unveiled before Biden’s message to the nation on Wednesday afternoon, includes about $200 billion to ensure access to preschool education for all children between the ages of 3 and 4.

[Biden’s new stimulus plan won’t raise your taxes. But here’s what you need to know]

The policy will be based on a partnership with state governments to cover the costs of existing programmes at the local level, which will be expanded. At first, federation is expected to cover up to 90% of costs, although states are expected to end up contributing up to 50% of the budget.

“Preschool and higher education is something that has received a lot of bipartisan support at the state level. For example, in Tennessee community college was boosted thanks to the leadership of the Republican governor, and there are Republican governors defending universal access to preschool education,” a White House civilist said Tuesday in the call with journalists.

All employees participating in preschool programs would earn at least $15 an hour under the legislative proposal.

© Provided by Telemundo Children in a preschool classroom in Chicago

Two years of universal higher education paid for The Biden Administration has proposed covering community college attendance costs for all students in the country who are interested in this higher education offering other than traditional universities.

Community colleges are institutes that offer anassociates degree, similar to abachelor’s degree, but are earned in just two years, after which there is often the opportunity to continue studying at a university to earn the corresponding degree. As with preschool education, the free community college would be funded through a partnership between state and federal governments.

[This is how Biden raises taxes to pay for its new infrastructure-focused stimulus plan]

Although the amount allocated by the federation would vary depending on the cost of tuition in each state, on average 75% of the tuition would be sought with federal funds,according to a White House official. In the event that there are states that do not want to contribute to the financing of the two free years of community college, or universal preschool education, the federal government plans to partner with town halls and civil society organizations in order to cover program costs.

“These investments will give the United States an advantage and pave the way for the most educated generation in the country’s history,” a Biden Administration official added in Tuesday’s call.

Childcare help As part of the attempt to redefine the concept of infrastructure, the Biden Administration seeks to provide $225 billion to help families pay for childcare services. “The family plan will provide access to quality child care.

In this proposal we guarantee that low- and middle-income families will pay no more than 7% of their income to care for their children,” Biden said in his message to the nation on Wednesday.

While most Republicans have opposed the idea of considering such services for working families as infrastructure, a concept traditionally associated with building roads, bridges, and ports, many Democrats advocate paradigm shift. “Child care is infrastructure,” Senator Elizabeth Warren, a Democrat for Massachusetts, recently said.

“Infrastructure is about people being able to get to work: roads, bridges, communications, and childcare is part of that,” he added. Biden announced that the proposal will also include up to 12 weeks of paid leave at work to care for a sick family member or spouse.

“No one has to choose between employment or preying on a loved one or his spouse or a child,” Biden emphasized. Fighting child hunger with school lunches The family plan also plans to allocate millions of dollars in funding to turn a program that will expand school lunches to summer this year into something permanent.

This not only seeks to keep children from going hungry when schools close for summer holidays, but also to help 34 million children get better nutrition year-round.

Funding the initiative The Biden Administration has proposed funding the ambitious plan for families, which would cost taxpayers about $1 trillion, doubling the tax rate on earnings to those who file income returns over $1 million annually.

Officials have ensured that people earning less than $400,000 a year would not see an increase reflected in the taxes they must pay.

However, people exceeding that annual income would be sought to repay a 39.6% fee, a levy that the previous administration had reduced with the 2017 tax reform.

Additionally, efforts would be made to invest in the IRS to make tax collection more efficient. Focusing mainly on combating the tax avoidance of corporations and the richest 1% of the population, according to a White House official.

Will Congress approve it? As with the infrastructure package presented by the president last month, there is expected to be strong opposition from Republicans to pass a move that would require an increase in taxes and the annulment of the 2017 tax reform passed by former President Donald Trump.

Last week, Republican lawmakers presented an alternative infrastructure plan that focused on building roads, railroads, airports and accounted for only a quarter of the cost of the Democratic plan.

© Provided by Telemundo South Carolina Republican Senator Tim Scott

Senator Tim Scott,a Republican for South Carolina, criticized the Plan for American Families on Wednesday night in his rebuttal of the president’s first speech to Congress, claiming that it would be too expensive and that it would raise taxes.

“It’s a liberal wish list that will waste the government’s money in a big way,” Scott said, in a preview of the opposition that Republicans will present to Biden’s proposed investment packages.

how can we help you?

Visit us at the office closest to you or request an online telematics advice by clicking the following link.

We have TWO locations:

📍2919 Fulton St

Brooklyn, NY 11207

📍619 Wilson Ave

Brooklyn, NY 11207

Beyond Your Expectations!

#fenixmar #fenixmarsolutions #thebesttaxpreparersnyc #taxseason2025 #beyondyourexpectations ...

We are FenixMar Solutions! 🇺🇸

Beyond Your Expectations! 🦅

#fenixmar #fenixmartv #fenixmarsolutions #thebesttaxpreparersnyc #taxseason2025 ...

Be prepared!

Tax Season 2025 🇺🇸

Beyond Your Expectations 🦅

#fenixmar #fenixmarsolutions #fenixmartv #thebesttaxpreparersnyc #taxseason2025 #fenixmargroup ...

We provide immigration services, including adjustment of status, citizenship, petitions, offering personalized guidance for every case

Beyond Your Expectations! 🦅

#fenixmar #fenixmarsolutions #fenixmartv #thebesttaxpreparersnyc #immigrationservicesnyc ...

We offer professional translations and reliable apostille services.

Beyond Your Expectations! 🦅

Tax Season 2025 🇺🇸

#fenixmar #fenixmarsolutions #fenixmartv #thebesttaxpreparersnyc #taxseason2025 ...

Notary Public Available

📍2919 Fulton St

Brooklyn, NY 11207

📍619 Wilson Ave

Brooklyn, NY 11207

Tax Season 2025!

We are ready!

Beyond Your Expectations! 🦅

#fenixmar #fenixmarsolutions #fenixmartv #thebesttaxpreparersnyc #beyondyourexpectations ...

Officially Open!

📍619 Wilson Ave

Brooklyn, NY 11207

Tax Season 2025! 🇺🇸

#fenixmar #fenixmarsolutions #thebesttaxpreparersnyc #taxseason2025 ...

Our Fulton St Office is waiting for you!

Tax Season 2025! 🇺🇸

Beyond Your Expectations!

#fenixmar #fenixmartv #fenixmarsolutions #thebesttaxpreparersnyc #taxseason2025 ...

Our Wilson Ave Branch is ready!

Tax Season 2025! 🇺🇸

Beyond Your Expectations!

#fenixmar #fenixmarsolutions #fenixmartv #thebesttaxpreparersnyc #taxseason2025 ...